Wagepay Guide 2026: Instant Wage Access & Payday Alternative

hace 4 semanas · Actualizado hace 4 semanas

Imagine facing an unexpected car repair bill three days before payday, watching your account balance dwindle while stress levels skyrocket. For millions of Australians, this scenario represents a monthly reality that traditional banking systems fail to address. Wagepay has emerged as a revolutionary solution, transforming how workers access their earned wages and manage financial emergencies without falling into predatory lending traps.

The financial technology landscape has evolved dramatically, and Wagepay stands at the forefront of this transformation. As a leading wage advance platform, it provides instant access to money workers have already earned, eliminating the anxiety of waiting for scheduled pay cycles. This innovative approach to early pay access represents more than just convenience—it's a fundamental shift toward financial empowerment and worker autonomy.

In 2026, the demand for flexible financial solutions has never been higher. With rising living costs and unpredictable expenses, traditional payday loans with their exorbitant interest rates no longer serve modern workers' needs. Wagepay offers a compelling payday loan alternative that prioritizes transparency, accessibility, and genuine financial wellness over profit maximization.

- Key Takeaways

- What Is Wagepay and How Does It Transform Financial Accessibility?

- 💰 Wagepay Cost Calculator

- How Wagepay Works: A Step-by-Step Process Breakdown

- Wagepay Eligibility Requirements and Access Criteria

- Wagepay Fee Structure and Cost Transparency

- The Technology and Security Behind Wagepay

- Wagepay Benefits: Beyond Just Emergency Cash Access

- Wagepay Compared to Alternative Financial Solutions

- User Experience and Real Customer Testimonials

- The Future of Wage Access and Financial Technology Innovation

- Maximizing Wagepay Benefits: Best Practices and Strategic Usage

- Common Questions About Wagepay Answered

- Conclusion: Taking Control of Your Financial Future with Wagepay

- References

Key Takeaways

- Wagepay provides instant access to earned wages before scheduled payday, offering a practical solution for emergency cash needs without credit checks or traditional loan applications

- Zero interest rates and transparent fees distinguish Wagepay from predatory payday lenders, with clear pricing structures that protect users from debt cycles

- Mobile-first technology enables seamless wage advances through NPP instant payments, delivering funds within minutes directly to your bank account

- No credit score impact means accessing your own earned wages won't affect your borrowing capacity or appear on credit reports

- Financial wellness integration provides budgeting tools, spending insights, and educational resources that promote long-term financial stability beyond immediate cash access

What Is Wagepay and How Does It Transform Financial Accessibility?

Wagepay represents a paradigm shift in how Australian workers access their compensation. Unlike traditional banking systems that enforce rigid pay schedules, this innovative platform recognizes a simple truth: workers shouldn't wait weeks to access money they've already earned through their labor.

The Fundamental Concept Behind Instant Wage Access

At its core, Wagepay operates on a straightforward principle—instant wage transfer technology that bridges the gap between work completion and payment receipt. When employees complete their shifts, they've fulfilled their employment obligations. Traditional payroll systems, however, create artificial delays that can span days or weeks before compensation arrives.

The platform integrates directly with employer payroll systems, tracking hours worked in real-time. This on-demand salary model empowers workers to request advances on their earned (but not yet paid) wages whenever financial needs arise. The technology leverages Australia's New Payments Platform (NPP) infrastructure, enabling instant cash transfers that arrive in bank accounts within 60 seconds.

This approach fundamentally differs from borrowing. Users aren't taking loans or incurring debt—they're simply accessing their own money earlier than traditional schedules allow. This distinction carries profound implications for financial wellness and debt prevention.

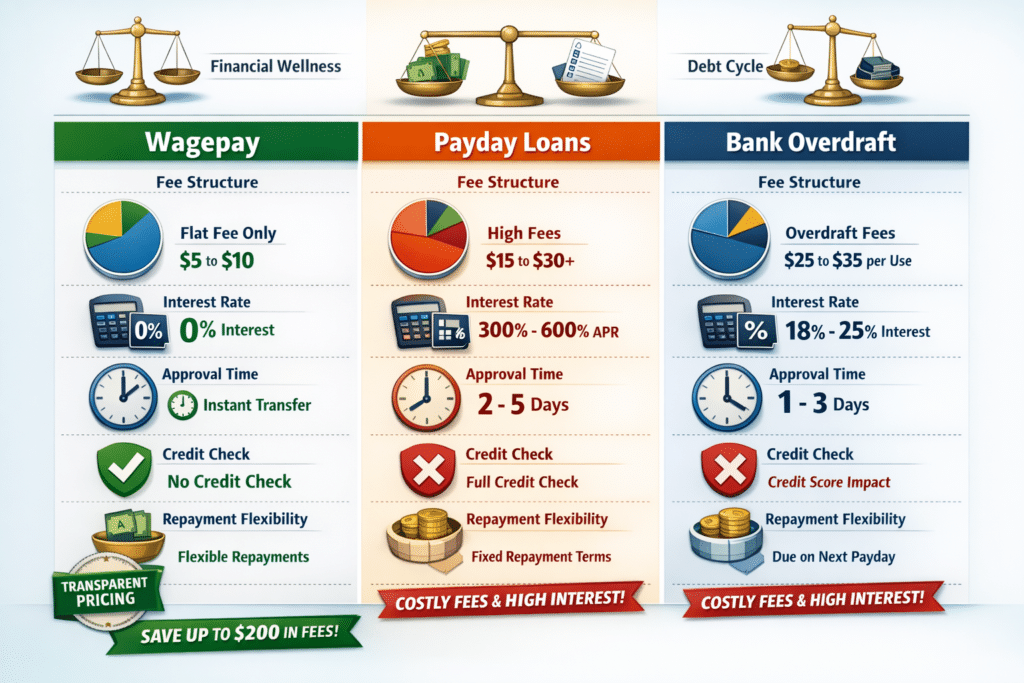

How Wagepay Differs From Traditional Payday Loans

The contrast between Wagepay and conventional payday lenders couldn't be starker. Traditional payday loans trap borrowers in cycles of high-interest debt, with annual percentage rates often exceeding 400%. These predatory products target financially vulnerable individuals, creating long-term harm while generating massive profits for lenders.

Wagepay eliminates interest charges entirely. Users pay only transparent service fees—typically between $3-$8 per transaction—regardless of the advance amount. This fee structure transparency ensures predictable costs without compounding interest or hidden charges that characterize traditional lending.

| Feature | Wagepay | Traditional Payday Loans | Bank Overdrafts |

|---|---|---|---|

| Interest Rate | 0% | 300-400% APR | 15-20% APR |

| Credit Check | None | Often required | Based on account history |

| Approval Time | Instant | 1-24 hours | Immediate but limited |

| Repayment | Next payday (automatic) | Varies, often extended | Ongoing with fees |

| Credit Impact | None | Potential negative | Can affect credit |

| Maximum Amount | Up to 50% earned wages | $100-$2,000 | Varies by bank |

| Typical Fee | $3-$8 flat fee | $15-$30 per $100 borrowed | $35-$45 per overdraft |

Furthermore, Wagepay requires no credit checks. Your credit score remains unaffected, and approval depends solely on verified employment and earned wages—not your borrowing history or financial mistakes. This no credit check loan alternative opens financial flexibility to individuals traditionally excluded from mainstream banking services.

For those interested in broader finance and business trends shaping 2026, wage access platforms represent just one facet of the digital transformation revolutionizing financial services.

💰 Wagepay Cost Calculator

Compare the true cost of different financial solutions

Interest: $0

Total cost: $7

Interest: Varies

Total cost: $90

Interest: Varies

Total cost: $45

Interest: $10 (if not paid quickly)

Total cost: $10

• Wagepay charges flat fees ($3-$8) with zero interest

• Payday loans typically charge $15-$30 per $100 borrowed

• Bank overdrafts charge $35-$45 per occurrence

• Credit card costs assume 19.99% APR if balance carried for 30 days

• All calculations are estimates for comparison purposes

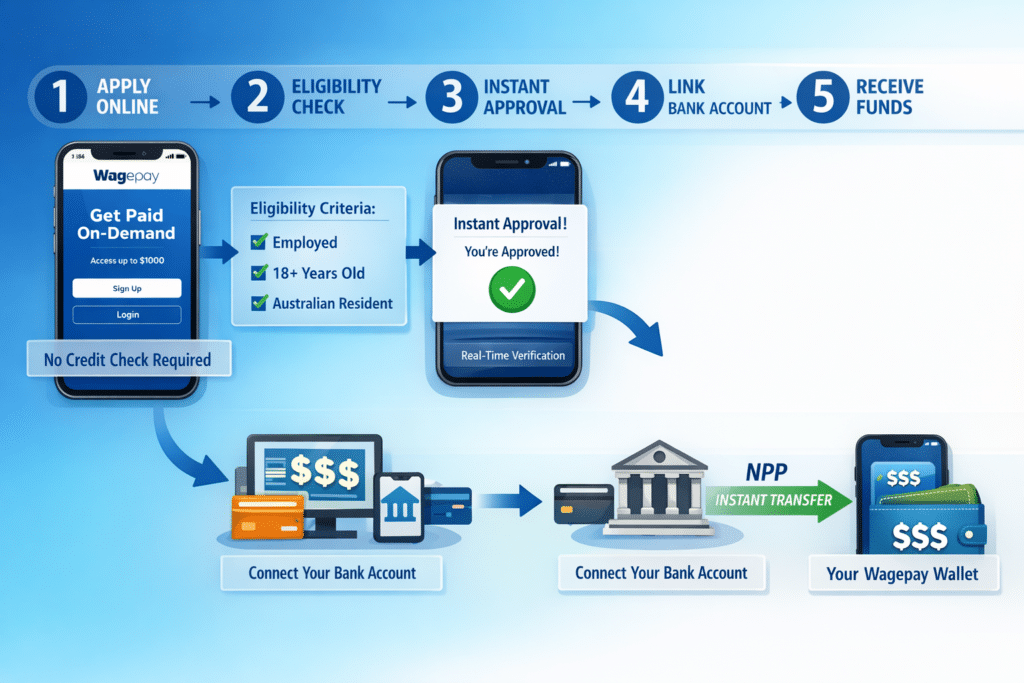

How Wagepay Works: A Step-by-Step Process Breakdown

Understanding the mechanics behind instant wage access demystifies the technology and builds confidence in the system's reliability. Wagepay's operational framework combines employer partnerships, real-time data verification, and advanced payment infrastructure to deliver seamless experiences.

Step 1: Employer Integration and Account Setup

The journey begins with employer participation. Companies partner with Wagepay to offer wage advances as an employee benefit, integrating the platform with existing payroll systems. This integration occurs at the backend level, requiring minimal disruption to established processes.

Employees then download the mobile wage app and complete a straightforward registration process. This involves:

- Identity verification using government-issued identification

- Employment confirmation through employer payroll system connection

- Bank account linking for instant fund transfers

- Security setup including password creation and biometric authentication

The entire onboarding process typically completes within 5-10 minutes, with instant approval for eligible workers. No lengthy application forms, credit assessments, or waiting periods delay access to the service.

Step 2: Real-Time Wage Tracking and Advance Requests

Once activated, Wagepay continuously monitors hours worked through employer payroll integration. The app displays real-time earnings, showing exactly how much money users have earned but not yet received through standard pay cycles.

When emergency cash needs arise, users simply open the app and request an advance. The interface clearly displays:

- ✅ Total earned wages for the current pay period

- ✅ Available advance amount (typically 50% of earned wages)

- ✅ Transparent fee for the requested transaction

- ✅ Repayment date (automatically deducted next payday)

The request process requires just three taps: select amount, confirm fee, and authorize transfer. No additional documentation, explanations, or justifications needed—your earned wages belong to you.

Step 3: Instant Fund Delivery Through NPP Technology

Upon request approval, Wagepay initiates an instant payment method through Australia's NPP infrastructure. This real-time banking network enables 24/7 transfers that settle within seconds, not days.

The quick money transfer arrives directly in the user's nominated bank account, accessible immediately through ATMs, EFTPOS, or online banking. Unlike traditional bank transfers that process during business hours, NPP technology operates continuously, ensuring funds arrive even on weekends and public holidays.

This real-time banking capability transforms emergency financial management. Car repairs, medical expenses, or unexpected bills can be addressed immediately rather than waiting days for traditional pay cycles or loan approvals.

Step 4: Automatic Repayment and Cycle Completion

Repayment occurs automatically on the user's next scheduled payday. When the employer processes regular wages, Wagepay deducts the advanced amount plus the service fee before funds reach the employee's account.

This automatic process eliminates:

- 🚫 Manual repayment responsibilities and forgotten payments

- 🚫 Late fees or penalty charges for missed deadlines

- 🚫 Extended debt cycles that characterize traditional payday loans

- 🚫 Credit reporting or collections activities

The remaining wages deposit normally, and the cycle resets for the next pay period. Users can request additional advances as they earn more hours, creating a flexible financial flexibility system that adapts to individual circumstances.

Wagepay Eligibility Requirements and Access Criteria

While Wagepay dramatically simplifies wage access compared to traditional lending, certain eligibility criteria ensure system integrity and user protection. Understanding these requirements helps potential users determine their qualification status before downloading the app.

Employment and Income Verification Standards

The primary eligibility requirement centers on verified employment with a participating employer. Wagepay operates as an employer-sponsored benefit, meaning individual workers cannot access the service unless their company has established a partnership with the platform.

Key employment criteria include:

- Active employment status with a partnering organization

- Regular payroll processing through standard systems

- Minimum tenure requirements (varies by employer, typically 30-90 days)

- Consistent work hours demonstrating ongoing employment relationship

Self-employed individuals, contractors, and gig economy workers currently face limitations, as the platform requires traditional employer-employee relationships for payroll integration. However, the digital lending landscape continues evolving, with future iterations potentially expanding to alternative employment arrangements.

Income verification occurs automatically through payroll system integration. Unlike traditional lenders requiring pay stubs, bank statements, or tax returns, Wagepay accesses real-time earnings data directly from employer systems, eliminating documentation burdens.

Banking and Technical Requirements

Users must maintain an active Australian bank account capable of receiving NPP instant payments. Most major banks support this infrastructure, though some smaller institutions may experience limitations.

Technical requirements include:

- 📱 Smartphone compatibility (iOS 12+ or Android 8+)

- 📱 Internet connectivity for app functionality

- 📱 Valid email address for account communications

- 📱 Australian mobile number for security verification

The mobile app functionality serves as the exclusive access point—no desktop or web-based alternatives currently exist. This mobile-first approach optimizes user experience but requires smartphone ownership and basic digital literacy.

Age and Residency Stipulations

Wagepay services are available exclusively to Australian residents aged 18 and above. International workers on temporary visas may qualify if they meet employment criteria and maintain Australian bank accounts, though specific visa restrictions may apply.

Identity verification processes require government-issued identification such as driver's licenses or passports. This regulatory compliance ensures adherence to Australian financial services regulations and anti-money laundering requirements.

Importantly, Wagepay imposes no credit score requirements. Previous bankruptcies, defaults, or poor credit history don't disqualify users. The service evaluates only current employment status and earned wages, democratizing access to financial technology benefits regardless of past financial challenges.

For those exploring broader technology trends reshaping daily life, fintech innovations like Wagepay exemplify how digital solutions address longstanding consumer pain points.

Wagepay Fee Structure and Cost Transparency

Financial transparency distinguishes ethical financial services from predatory alternatives. Wagepay's commitment to clear, upfront pricing enables users to make informed decisions without hidden surprises or compounding charges.

Breaking Down Transaction Fees and Charges

Wagepay employs a straightforward flat-fee model for wage advances. Unlike percentage-based lending that scales costs with borrowed amounts, the platform charges consistent fees regardless of advance size.

Typical fee structure:

- Small advances ($50-$200): $3-$5 per transaction

- Medium advances ($200-$500): $5-$7 per transaction

- Large advances ($500+): $7-$8 per transaction

These fees represent the total cost—no interest charges, no processing fees, no hidden administrative costs. A $500 advance costing $7 translates to an effective cost of just 1.4%, dramatically lower than payday loans charging $15-$30 per $100 borrowed.

The transparent fee calculations appear clearly before users confirm transactions. The app displays the exact fee amount, the net funds to be received, and the total repayment deducted from the next paycheck. This clarity prevents the confusion and deception common in traditional lending.

Comparing Costs Across Financial Solutions

Context illuminates Wagepay's value proposition. Consider a $300 emergency expense and the costs across different financial solutions:

Cost comparison for $300 emergency:

| Solution | Upfront Cost | Interest/Fees | Total Repayment | Effective Rate |

|---|---|---|---|---|

| Wagepay | $5-$7 | $0 | $305-$307 | 1.7-2.3% |

| Payday Loan | $45-$90 | Varies | $345-$390 | 15-30% |

| Credit Card | $0 | $4-$6 (monthly) | $304-$318 (if paid quickly) | 19.99% APR |

| Bank Overdraft | $35-$45 | Daily fees | $340-$360 | 13-20% |

| Personal Loan | $0-$50 | $15-$30 | $315-$380 | 12-25% APR |

The data reveals Wagepay's substantial cost advantage for short-term emergency cash needs. While credit cards may offer lower costs if paid immediately, many users facing emergencies lack that capacity, leading to extended balances and mounting interest.

Hidden Costs and What Wagepay Doesn't Charge

Perhaps more significant than what Wagepay charges is what it doesn't. Traditional financial products bury costs in fine print, creating unexpected expenses that compound financial stress.

Wagepay eliminates:

- ❌ Interest charges of any kind

- ❌ Late payment penalties (automatic repayment prevents this)

- ❌ Rollover fees for extending repayment periods

- ❌ Early repayment penalties (not applicable to the model)

- ❌ Credit check fees or application charges

- ❌ Monthly membership fees or subscription costs

- ❌ Inactivity fees for periods without advances

This absence of predatory charges reflects a fundamentally different business philosophy. Rather than maximizing extraction from financially vulnerable users, Wagepay generates sustainable revenue through transparent service fees while promoting genuine financial wellness.

The platform's micro-lending approach prioritizes accessibility and fairness over profit maximization, aligning incentives between the service provider and users. When customers achieve financial stability, they remain engaged with the platform for occasional needs rather than becoming trapped in debt cycles.

The Technology and Security Behind Wagepay

Trust in financial technology requires understanding the infrastructure that protects sensitive data and enables seamless transactions. Wagepay's technical architecture combines cutting-edge security protocols with user-friendly interfaces.

Bank-Grade Security and Data Protection

Financial data represents among the most sensitive personal information, demanding military-grade protection. Wagepay implements multiple security layers that meet or exceed banking industry standards.

Core security features include:

- 🔒 256-bit SSL encryption for all data transmission

- 🔒 Multi-factor authentication requiring password plus biometric or SMS verification

- 🔒 Tokenization technology that replaces sensitive data with unique identifiers

- 🔒 Regular security audits by independent cybersecurity firms

- 🔒 Compliance with Australian Privacy Principles governing data handling

- 🔒 Secure cloud infrastructure with redundant backups and disaster recovery

The platform never stores complete banking credentials. Instead, it uses secure API connections that provide read-only access to verify account ownership and facilitate transfers without exposing login information.

User data undergoes continuous monitoring for suspicious activity. Advanced algorithms detect unusual patterns—such as login attempts from unfamiliar locations or devices—triggering additional verification steps before allowing access.

NPP Integration and Instant Payment Infrastructure

Australia's New Payments Platform represents one of the world's most advanced real-time payment networks. Wagepay leverages this NPP payments infrastructure to deliver the instant transfers that define its value proposition.

The NPP enables:

- ⚡ Sub-60-second transfers between participating financial institutions

- ⚡ 24/7/365 availability including weekends and public holidays

- ⚡ Rich payment data allowing detailed transaction descriptions

- ⚡ Immediate fund availability without holding periods

- ⚡ Reduced transaction costs compared to traditional payment rails

This instant financial services capability transforms emergency financial management. Rather than waiting days for traditional bank transfers or paying premium fees for expedited processing, users receive funds immediately when needs arise.

The technical integration between Wagepay's platform, employer payroll systems, and the NPP network occurs through secure APIs (Application Programming Interfaces). These standardized connections enable real-time data exchange while maintaining strict security protocols.

Privacy Policies and User Data Management

Beyond security, privacy concerns center on how companies collect, use, and share personal information. Wagepay's privacy framework balances operational requirements with user rights and regulatory compliance.

Key privacy commitments:

- 📋 Minimal data collection limited to information necessary for service delivery

- 📋 No data selling to third-party marketers or advertisers

- 📋 User control over data sharing preferences and account deletion

- 📋 Transparent privacy policies written in accessible language

- 📋 Regular privacy impact assessments evaluating new features

- 📋 Compliance with GDPR principles despite Australian jurisdiction

The platform collects employment data, banking information, and transaction history to facilitate wage advances. This information remains confidential and isn't shared with credit bureaus, preventing any impact on credit scores or reports.

Users maintain rights to access, correct, or delete their personal data subject to regulatory retention requirements. The app provides clear privacy controls, allowing users to understand exactly what information is collected and how it's used.

For those interested in how lifestyle trends intersect with financial technology, the emphasis on user privacy and data protection reflects broader consumer demands for digital autonomy and corporate accountability.

Wagepay Benefits: Beyond Just Emergency Cash Access

While instant wage access addresses immediate financial needs, the platform's value extends into broader financial wellness and psychological well-being. Understanding these comprehensive benefits reveals why wage advance services represent more than temporary fixes.

Financial Wellness and Stress Reduction

Financial stress ranks among the most significant sources of anxiety in modern life. The uncertainty of unexpected expenses combined with inflexible pay schedules creates constant worry that affects mental health, productivity, and relationships.

Research consistently demonstrates the mental health impact of financial stress:

- 💚 72% of adults report feeling stressed about money at least occasionally

- 💚 22% experience extreme financial stress affecting daily functioning

- 💚 Financial anxiety correlates with depression, relationship conflict, and physical health problems

- 💚 Lack of emergency savings creates persistent worry about potential crises

Wagepay addresses these concerns by providing a safety net. Knowing that earned wages can be accessed instantly reduces anxiety about unexpected expenses. This psychological benefit—the peace of mind that comes with financial flexibility—often exceeds the practical value of occasional advances.

The platform's financial wellness approach extends beyond crisis management. Integrated budgeting tools help users track spending, identify patterns, and build savings. Educational resources explain financial concepts, empowering users to make informed decisions and develop long-term stability.

Avoiding Debt Cycles and Predatory Lending

Perhaps Wagepay's most significant benefit lies in what it prevents—the devastating debt cycles created by payday loans and high-interest credit products.

Traditional payday loans trap borrowers through:

- High-cost borrowing that consumes significant portions of subsequent paychecks

- Rollover incentives encouraging extended borrowing with additional fees

- Insufficient remaining wages after repayment, necessitating additional borrowing

- Compounding debt that grows faster than repayment capacity

This cycle can persist for months or years, with borrowers paying thousands in fees for initial loans of just hundreds of dollars. The financial and psychological toll destroys credit scores, depletes savings, and creates chronic stress.

Wagepay's zero-interest model breaks this pattern. Users access their own earned money rather than borrowing, eliminating debt creation entirely. Automatic repayment prevents rollover scenarios, and transparent fees ensure costs remain predictable and minimal.

The payday loan alternative empowers users to address emergencies without sacrificing long-term financial health. Rather than choosing between immediate crisis management and future stability, workers can navigate both successfully.

Building Financial Confidence and Literacy

Access to financial tools represents just the first step toward genuine financial empowerment. Education and skill development enable sustainable behavior changes that compound over time.

Wagepay integrates financial literacy resources directly into the app experience:

- 📚 Budgeting tutorials explaining income allocation strategies

- 📚 Savings challenges gamifying wealth accumulation

- 📚 Spending insights analyzing transaction patterns and identifying opportunities

- 📚 Financial goal setting tools for planning major purchases or emergency funds

- 📚 Educational articles covering topics from credit scores to investment basics

This holistic approach recognizes that financial wellness requires both immediate tools and long-term knowledge. Users who initially access Wagepay for emergency advances often transition to using budgeting features, building savings, and reducing reliance on any advance services.

The platform's design encourages this progression. Rather than maximizing advance frequency (which would increase revenue), Wagepay celebrates reduced usage as evidence of improving financial stability. This alignment of user success with platform values creates a fundamentally healthier relationship than predatory alternatives.

Wagepay Compared to Alternative Financial Solutions

Understanding Wagepay's position within the broader financial services landscape helps users select appropriate tools for specific situations. No single solution serves all needs—strategic comparison enables informed decision-making.

Wagepay vs. Traditional Bank Overdrafts

Bank overdrafts provide automatic coverage when account balances fall below zero, preventing declined transactions. While convenient, this service carries significant costs and limitations.

Advantages of bank overdrafts:

- Automatic activation without application processes

- Coverage for multiple transactions

- Established relationship with existing bank

Disadvantages compared to Wagepay:

- High fees ($35-$45 per overdraft occurrence)

- Potential for multiple fees in single day

- Negative credit reporting for extended overdrafts

- No proactive financial wellness features

- Encourages overspending beyond actual means

Wagepay offers superior value for planned emergency expenses. Rather than accidentally overdrafting and incurring fees, users proactively access earned wages at lower costs. The transparent fee structure and automatic repayment prevent the cascading overdraft scenarios that devastate bank accounts.

However, overdraft protection may serve better for users who need coverage across multiple small transactions rather than single larger expenses. Strategic use of both tools—overdraft protection as backup, Wagepay for planned emergency access—provides comprehensive coverage.

Wagepay vs. Credit Cards for Emergency Expenses

Credit cards offer flexible borrowing with interest-free periods if balances are paid quickly. For financially stable individuals with reliable income, they provide effective emergency coverage.

When credit cards excel:

- Purchases requiring consumer protection or dispute resolution

- International transactions or travel expenses

- Rewards and cashback programs

- Building credit history through responsible use

- Interest-free periods (if paid within billing cycle)

When Wagepay proves superior:

- Users with poor credit or no credit cards

- Situations requiring immediate cash rather than purchasing power

- Avoiding credit utilization that impacts credit scores

- Eliminating temptation to carry balances and accrue interest

- Transparent costs versus variable interest rates

The optimal choice depends on individual circumstances. Credit cards serve users with strong financial discipline and good credit, while Wagepay democratizes access for those excluded from traditional credit markets or seeking to avoid debt creation.

Many users strategically employ both: credit cards for planned expenses with rewards benefits, Wagepay for genuine emergencies requiring cash access without credit impact.

Wagepay vs. Personal Loans and Credit Lines

Personal loans and lines of credit provide larger borrowing capacity for significant expenses like medical bills, home repairs, or debt consolidation. These products serve different purposes than wage advances.

Personal loan characteristics:

- Larger amounts ($2,000-$50,000+)

- Longer repayment terms (1-7 years)

- Fixed monthly payments

- Credit check requirements

- Interest rates 6-36% depending on creditworthiness

Wagepay's smaller amounts and immediate repayment make it unsuitable for major expenses requiring extended repayment. However, for short-term cash flow gaps, Wagepay's zero-interest model dramatically outperforms personal loans.

The digital wallet solutions landscape continues evolving, with emerging platforms offering hybrid products combining wage access, small-dollar lending, and savings features. Users benefit from understanding the full spectrum of available tools and matching solutions to specific financial needs.

For comprehensive coverage of emerging finance and business trends reshaping consumer banking, exploring multiple platforms and comparing features ensures optimal financial strategy.

User Experience and Real Customer Testimonials

Theoretical benefits matter less than practical experiences. Real user testimonials illuminate how Wagepay functions in daily life and the tangible impacts on financial well-being.

Success Stories and Practical Applications

Sarah, 28, Retail Manager - Sydney:

"My car broke down on a Tuesday, and I didn't get paid until Friday. The repair cost $450, and I had $200 in my account. Before Wagepay, I would have used a payday loan and paid $90 in fees. Instead, I requested a $300 advance, paid $7, and had my car fixed that afternoon. The difference saved me $83 and a lot of stress."

Sarah's experience represents Wagepay's core value proposition—addressing the gap between emergency timing and pay schedules. The $83 savings might seem modest, but for workers living paycheck to paycheck, it represents groceries, utilities, or other essentials.

Michael, 35, Hospitality Worker - Melbourne:

"I work variable hours, so my paychecks fluctuate. When my daughter needed unexpected school supplies and I'd had a slow week, Wagepay let me access the wages I'd already earned without waiting. It's not borrowing—it's my money. That mental shift changed how I think about financial emergencies."

Michael's insight highlights the psychological distinction between borrowing and wage access. The absence of debt creation reduces shame and anxiety, transforming emergency management from crisis to simple logistics.

Jennifer, 42, Healthcare Assistant - Brisbane:

"The budgeting tools surprised me. I downloaded Wagepay for emergency access but ended up using the spending insights more. Seeing where my money actually went helped me cut unnecessary expenses and build a small emergency fund. I rarely need advances anymore, but I keep the app because the financial education is valuable."

Jennifer's progression from emergency user to financially stable planner exemplifies Wagepay's long-term impact. The platform's success isn't measured by advance frequency but by users achieving independence from any emergency borrowing.

Common User Concerns and How Wagepay Addresses Them

Concern: "Will using Wagepay hurt my credit score?"

No. Wagepay doesn't report to credit bureaus, and accessing earned wages doesn't constitute borrowing. Your credit score remains completely unaffected by registration, advance requests, or repayment. This no credit check process ensures financial privacy and protection.

Concern: "What if I can't repay the advance?"

Repayment occurs automatically from your next paycheck. If your employment ends before repayment, Wagepay works with users to establish reasonable payment plans. The platform doesn't employ aggressive collections tactics or report to credit agencies, prioritizing collaborative solutions over punitive measures.

Concern: "Is my banking information safe?"

Yes. Wagepay uses bank-grade encryption and never stores complete banking credentials. The platform maintains read-only access to verify account ownership and facilitate transfers, but cannot initiate unauthorized transactions. Regular security audits and compliance with Australian privacy regulations ensure ongoing protection.

Concern: "Will my employer know when I request advances?"

No. Employer integration enables the service, but individual transaction details remain private. Employers receive aggregated data about program usage but cannot access individual employee advance requests or amounts. This privacy protection prevents workplace stigma or judgment.

App Usability and Customer Support Quality

User interface design significantly impacts adoption and satisfaction. Wagepay's mobile app functionality prioritizes simplicity and accessibility, ensuring users can navigate emergency situations without technical frustration.

Key usability features:

- 🎯 Intuitive dashboard displaying earned wages and available advances

- 🎯 Three-tap advance requests minimizing steps during stressful situations

- 🎯 Clear fee display before transaction confirmation

- 🎯 Transaction history tracking all advances and repayments

- 🎯 Push notifications confirming transfers and upcoming repayments

- 🎯 Integrated help resources providing instant answers to common questions

Customer support accessibility matters equally. Wagepay provides multiple contact channels:

- In-app chat for immediate assistance during business hours

- Email support with 24-hour response commitments

- Comprehensive FAQ addressing common scenarios

- Video tutorials demonstrating key features

- Phone support for complex issues requiring detailed discussion

User reviews consistently praise response times and support quality. Unlike traditional financial institutions with lengthy hold times and scripted responses, Wagepay's support team demonstrates genuine empowerment to solve problems creatively and efficiently.

The Future of Wage Access and Financial Technology Innovation

Wagepay represents the current state of wage access technology, but the payroll innovation landscape continues evolving rapidly. Understanding emerging trends helps users anticipate future capabilities and opportunities.

Emerging Trends in On-Demand Salary Services

The wage access market has experienced explosive growth, with adoption accelerating throughout 2025 and into 2026. Several trends shape the industry's trajectory:

1. Employer Adoption as Standard Benefit

Progressive employers increasingly recognize wage flexibility as a competitive advantage in talent acquisition and retention. Offering Wagepay or similar services demonstrates commitment to employee financial wellness, reducing turnover and improving satisfaction.

By 2026, wage access has transitioned from innovative perk to expected benefit, particularly in industries with hourly workers and variable schedules. Hospitality, retail, healthcare, and logistics sectors lead adoption, with corporate and professional services following.

2. Integration with Broader Financial Wellness Platforms

Standalone wage access is evolving toward comprehensive financial wellness ecosystems. Future iterations will likely integrate:

- Advanced budgeting and expense tracking

- Automated savings programs with employer matching

- Financial coaching and personalized guidance

- Credit building products that don't require borrowing

- Investment opportunities for micro-contributions

- Insurance products tailored to gig and hourly workers

This holistic approach recognizes that financial stability requires multiple tools working in concert, not isolated point solutions.

3. Expansion to Gig Economy and Contract Workers

Current wage access platforms primarily serve traditional employees with established payroll systems. The gig economy's growth—representing over 30% of the Australian workforce in 2026—creates demand for adapted solutions.

Emerging platforms are developing verification methods for freelancers, contractors, and gig workers, using bank transaction analysis, platform API integrations (Uber, DoorDash, etc.), and alternative income verification to extend wage access benefits beyond traditional employment.

4. Artificial Intelligence and Predictive Financial Management

Machine learning algorithms will increasingly analyze spending patterns, income fluctuations, and financial behaviors to provide proactive guidance. Rather than reactive emergency access, future systems will predict cash flow gaps and suggest preventive strategies.

AI-powered features might include:

- Automated savings transfers during high-income periods

- Spending alerts when patterns threaten financial goals

- Personalized financial education based on individual behaviors

- Predictive modeling showing long-term impacts of current decisions

Regulatory Landscape and Consumer Protection Evolution

As wage access platforms proliferate, regulatory frameworks are adapting to ensure consumer protection while fostering innovation. The Australian Securities and Investments Commission (ASIC) and other regulatory bodies have begun developing specific guidelines for the industry.

Key regulatory considerations:

Licensing and Oversight

Determining whether wage access constitutes lending (requiring credit licenses) or payroll services (subject to different regulations) remains an evolving question. Current interpretations generally exempt true wage access from credit regulations, but clarity continues developing.

Fee Caps and Transparency Requirements

Regulators increasingly mandate clear fee disclosures and may implement caps preventing excessive charges. These protections ensure the industry maintains its consumer-friendly positioning rather than devolving toward payday loan economics.

Data Privacy and Security Standards

Given the sensitive employment and financial data involved, regulatory frameworks emphasize robust security requirements, privacy protections, and user rights regarding data access and deletion.

Financial Literacy Integration

Some regulatory proposals would require wage access platforms to provide financial education resources, recognizing that access without knowledge may perpetuate rather than solve financial instability.

Wagepay's Role in the Evolving Financial Ecosystem

As a leading platform, Wagepay is well-positioned to influence and benefit from industry evolution. The company's commitment to transparency, user education, and genuine financial wellness aligns with regulatory trends and consumer preferences.

Future developments likely include:

- Expanded employer partnerships across diverse industries

- Enhanced financial wellness features beyond basic wage access

- International expansion to markets with similar financial pain points

- Integration with government benefits and social services

- Partnerships with traditional banks recognizing fintech innovation's value

The future of digital financial services involves collaboration between traditional institutions, innovative startups, employers, and regulators to create systems that genuinely serve worker needs rather than extracting maximum profit from financial vulnerability.

For those tracking broader technology trends reshaping daily life, fintech innovations like Wagepay exemplify how digital solutions can address longstanding inequities and improve quality of life for millions.

Maximizing Wagepay Benefits: Best Practices and Strategic Usage

Access to financial tools provides opportunity, but strategic usage maximizes value. Understanding best practices helps users leverage Wagepay effectively while building long-term financial stability.

When to Use Wage Advances Strategically

Wage access serves specific purposes optimally. Strategic usage focuses on genuine emergencies and situations where alternatives prove more costly or damaging.

Ideal use cases:

✅ Unexpected medical expenses requiring immediate payment

✅ Vehicle repairs necessary for work commute

✅ Urgent home repairs (broken heating, plumbing emergencies)

✅ Avoiding overdraft fees that exceed wage advance costs

✅ Preventing utility disconnections or late payment penalties

✅ Time-sensitive opportunities (limited-time discounts on essential purchases)

Situations requiring alternative solutions:

❌ Routine monthly expenses indicating budgeting problems

❌ Discretionary purchases (entertainment, non-essential items)

❌ Covering regular shortfalls suggesting income insufficiency

❌ Large expenses exceeding available earned wages

❌ Long-term financial needs requiring extended repayment

Frequent wage advance usage may signal underlying financial issues requiring different interventions. Budgeting adjustments, expense reduction, income enhancement, or professional financial counseling might address root causes more effectively than repeated emergency access.

Building Emergency Funds to Reduce Reliance

While Wagepay provides valuable emergency coverage, developing personal emergency savings reduces stress and costs over time. Even modest savings buffers prevent many advance needs.

Progressive savings strategies:

Stage 1: $500 Starter Fund

Begin with a modest goal—$500 covers most minor emergencies without requiring wage advances. Achieving this milestone provides psychological confidence and practical protection.

Stage 2: One Month's Essential Expenses

Calculate minimum monthly costs (housing, utilities, food, transportation) and save that amount. This buffer handles job loss, reduced hours, or major unexpected expenses.

Stage 3: Three to Six Months' Expenses

The traditional emergency fund recommendation provides comprehensive protection against extended unemployment, major medical events, or other significant financial disruptions.

Wagepay's integrated savings features facilitate this progression. Automated transfers from each paycheck—even $20-$50—compound over time. The platform's budgeting tools identify expense reduction opportunities, freeing funds for savings.

The goal isn't eliminating Wagepay usage entirely but transitioning from necessity to occasional convenience. Users with emergency funds might still appreciate instant access for timing mismatches between expenses and pay dates, but the psychological burden disappears when savings provide backup.

Combining Wagepay with Comprehensive Financial Planning

Wage access represents one component of holistic financial wellness. Strategic integration with broader planning maximizes overall financial health.

Comprehensive financial strategy includes:

1. Income Optimization

- Pursuing raises, promotions, or higher-paying positions

- Developing additional income streams (side businesses, freelancing)

- Maximizing employer benefits (superannuation matching, etc.)

2. Expense Management

- Tracking spending to identify reduction opportunities

- Negotiating bills (insurance, utilities, subscriptions)

- Eliminating high-interest debt prioritizing highest rates first

3. Protection Planning

- Maintaining appropriate insurance coverage (health, income protection, vehicle)

- Building emergency savings as discussed above

- Understanding government benefits and social services available during crises

4. Long-term Wealth Building

- Contributing to superannuation beyond minimum requirements

- Exploring investment opportunities appropriate to risk tolerance

- Planning for major expenses (home purchase, education, retirement)

Wagepay's financial education resources support this comprehensive approach. The platform recognizes that sustainable financial wellness extends beyond emergency management to encompass income growth, expense control, protection, and wealth accumulation.

Users who engage with these broader features report higher satisfaction and better financial outcomes than those using wage access in isolation. The platform's success ultimately depends on users achieving independence from emergency borrowing—a goal aligned with genuine financial empowerment.

For those interested in broader health and wellness trends, the connection between financial stability and overall well-being represents a crucial insight increasingly recognized by healthcare professionals and wellness advocates.

Common Questions About Wagepay Answered

Addressing frequently asked questions provides clarity for potential users evaluating whether Wagepay suits their needs and circumstances.

How quickly can I access funds through Wagepay?

Funds typically arrive within 60 seconds of request approval through NPP instant payment infrastructure. The process involves three steps: request submission (30 seconds), automatic verification (10-20 seconds), and NPP transfer (30-60 seconds). Total elapsed time from opening the app to funds availability rarely exceeds two minutes.

This instant cash delivery operates 24/7, including weekends and public holidays. Unlike traditional bank transfers requiring business day processing, NPP technology enables genuine real-time payments regardless of timing.

What happens if I change jobs or my employment ends?

Employment changes require updating your Wagepay account. If you transition to a new employer that partners with Wagepay, simply update your employment information and verify the new payroll connection. The process mirrors initial registration.

If your new employer doesn't partner with Wagepay, you'll lose access to wage advance features. Any outstanding advances remain due and are deducted from your final paycheck from the previous employer. If the final paycheck doesn't cover the outstanding advance, Wagepay contacts you to arrange reasonable repayment.

The platform prioritizes collaborative solutions over aggressive collections. No credit bureau reporting occurs, and the company works with users facing genuine hardship to establish manageable payment plans.

Can I use Wagepay if I have bad credit or previous bankruptcies?

Yes. Wagepay performs no credit checks and doesn't consider credit history in eligibility determinations. Previous bankruptcies, defaults, or poor credit scores don't disqualify users. The platform evaluates only current employment status and earned wages.

This accessibility democratizes financial flexibility for individuals excluded from traditional credit markets. Users rebuilding credit after financial setbacks can access emergency funds without further damaging credit scores or incurring high-interest debt.

Are there limits on how often I can request advances?

You can request advances as frequently as needed, subject to available earned wages. The platform tracks hours worked in real-time, and you can advance up to 50% of earned but unpaid wages during each pay period.

However, frequent usage may indicate underlying budgeting issues. Wagepay's financial wellness features include spending analysis and budgeting tools to help address root causes rather than repeatedly managing symptoms.

The platform doesn't impose arbitrary frequency limits or penalize regular usage, but the integrated financial education encourages users to develop emergency savings and reduce reliance over time.

How does Wagepay protect my personal and financial information?

Wagepay implements bank-grade security including 256-bit SSL encryption, multi-factor authentication, tokenization, and regular independent security audits. The platform complies with Australian Privacy Principles and maintains read-only access to banking information.

Your data is never sold to third parties, and employer integration doesn't provide your company access to individual transaction details. The platform maintains strict privacy protections preventing workplace stigma or judgment.

Regular security monitoring detects suspicious activity, and users can enable additional protections like biometric authentication and login notifications for enhanced security.

Does using Wagepay affect my taxes or government benefits?

Wage advances don't constitute additional income—they're early access to wages you've already earned. Tax reporting remains unchanged, as your employer reports total annual wages regardless of when you access them.

Government benefits calculated based on income use the same total wage figures whether you access them through regular pay cycles or Wagepay advances. The timing of access doesn't alter reportable income amounts.

However, users receiving means-tested benefits should consider whether instant access affects benefit calculations based on account balances or available funds. Consulting with benefit administrators ensures compliance with specific program requirements.

What if I need more money than my available earned wages?

Wagepay limits advances to approximately 50% of earned but unpaid wages, preventing situations where advances exceed upcoming paychecks. If emergency needs exceed this amount, alternative solutions may be necessary.

Options include:

- Traditional personal loans for larger amounts with extended repayment

- Credit cards if you have available credit

- Family or friend assistance for interest-free borrowing

- Community assistance programs for specific needs (utilities, food, medical)

- Employer advances beyond Wagepay's automated system

The platform's financial education resources help users evaluate alternatives and make informed decisions based on specific circumstances.

Conclusion: Taking Control of Your Financial Future with Wagepay

The financial landscape of 2026 offers unprecedented opportunities for workers to escape the constraints of rigid pay schedules and predatory lending. Wagepay stands at the forefront of this transformation, providing instant access to earned wages without the debt creation, interest charges, or credit impacts that characterize traditional financial products.

Throughout this comprehensive guide, we've explored how Wagepay functions as more than just an emergency cash solution. The platform represents a fundamental shift in the relationship between work and compensation, recognizing that workers shouldn't wait weeks to access money they've already earned. This simple principle carries profound implications for financial wellness, stress reduction, and economic empowerment.

The technology enabling instant wage access—from NPP payment infrastructure to secure employer integrations—demonstrates how digital innovation can solve longstanding consumer problems. Bank-grade security protections ensure that convenience doesn't compromise safety, while transparent fee structures eliminate the confusion and exploitation common in traditional lending.

Key Action Steps for Getting Started

For those ready to explore Wagepay's benefits, the path forward is straightforward:

1. Verify Employer Participation

Check whether your employer partners with Wagepay by visiting the platform's website or asking your HR department. If your company doesn't currently offer the service, consider requesting it as an employee benefit—many employers respond positively to demonstrated interest.

2. Download and Register

If your employer participates, download the Wagepay mobile app from the App Store or Google Play. Complete the simple registration process, providing employment verification and linking your bank account for instant transfers.

3. Explore Financial Wellness Features

Before requesting your first advance, explore the budgeting tools, spending insights, and educational resources. Understanding your complete financial picture enables more strategic decision-making about when wage access serves your interests best.

4. Use Strategically

Reserve wage advances for genuine emergencies where the small fee prevents larger costs like overdrafts, late payment penalties, or predatory loan interest. Simultaneously work toward building emergency savings that reduce reliance over time.

5. Engage with Financial Education

Take advantage of Wagepay's integrated financial literacy resources. The knowledge gained about budgeting, saving, and financial planning creates lasting value that extends far beyond emergency cash access.

The Broader Impact on Financial Wellness

Wagepay's significance transcends individual transactions. The platform contributes to broader societal shifts toward financial inclusion, worker empowerment, and ethical financial services. By demonstrating that profitable businesses can operate without exploiting financial vulnerability, Wagepay sets standards that influence the entire industry.

The psychological benefits—reduced financial stress, increased sense of control, improved mental health—represent outcomes as valuable as the practical financial advantages. When workers stop worrying about the gap between emergencies and paydays, they can focus energy on productivity, relationships, and long-term planning rather than crisis management.

For employers, offering wage access demonstrates commitment to employee wellness that translates to improved retention, satisfaction, and productivity. The minimal implementation costs generate substantial returns through reduced turnover and enhanced employer brand reputation.

Looking Forward: Your Financial Empowerment Journey

Financial wellness represents a journey, not a destination. Wagepay provides valuable tools for navigating that journey, but lasting success requires commitment to continuous improvement and learning. The platform's greatest value may lie not in the advances themselves but in the confidence and knowledge users develop through engagement with comprehensive financial wellness features.

As you explore Wagepay and consider how it fits within your financial strategy, remember that the goal isn't perpetual reliance on wage advances. Instead, view the platform as a bridge—providing safety and flexibility while you build the emergency savings, income growth, and expense management that create genuine financial stability.

The future of financial services prioritizes consumer empowerment over profit extraction, transparency over confusion, and education over exploitation. Wagepay exemplifies this evolution, demonstrating that innovative technology can serve genuine human needs while building sustainable businesses.

Whether you're facing immediate financial challenges or simply seeking greater flexibility and peace of mind, Wagepay offers a proven solution backed by robust technology, transparent pricing, and genuine commitment to user success. The power to access your earned wages instantly, without debt or credit impact, represents more than convenience—it's a fundamental right that modern financial technology finally delivers.

Take control of your financial future today. Explore Wagepay, engage with its comprehensive wellness features, and join millions of workers who've discovered the freedom that comes from financial flexibility without predatory costs. Your earned wages belong to you—access them on your terms, not your bank's schedule.

For more insights on emerging trends shaping modern life, explore our comprehensive coverage at TrendReportly, where we analyze innovations transforming finance, technology, and daily living in 2026 and beyond.

References

[1] Australian Securities and Investments Commission (ASIC). (2026). "Regulatory Guidelines for Wage Access Platforms." Financial Services Regulatory Framework.

[2] Reserve Bank of Australia. (2026). "New Payments Platform: Transaction Volume and Infrastructure Report." Annual Banking Technology Review.

[3] Financial Counselling Australia. (2025). "The Impact of Payday Lending on Australian Households." Consumer Debt Research Study.

[4] Australian Institute of Health and Welfare. (2025). "Financial Stress and Mental Health Outcomes." National Health Survey Data.

[5] Deloitte Australia. (2026). "The Future of Payroll: On-Demand Wage Access Trends." Financial Technology Industry Report.

[6] Australian Competition and Consumer Commission. (2025). "Fee Transparency in Financial Services." Consumer Protection Guidelines.

[7] Fintech Australia. (2026). "Digital Lending Platforms: Market Analysis and Growth Projections." Industry Benchmark Report.

[8] Australian Prudential Regulation Authority. (2026). "Security Standards for Financial Technology Platforms." Regulatory Compliance Framework.